Can Chase Sapphire Reserve Annual Fee Waived? One Simple Answer is NO. But before you cancel or downgrade, do go through some of their key benefits that can earn you back from the $550 Annual Fee. We will also see what other best options when we compare with Sapphire Reserve.

If you are an active servicemember and Chase can confirm your active duty status, they won’t charge you any fees.

Join this fb group to learn How to Maximize Ultimate Rewards MaximizeChaseUltimateRewards

Earn your Chase Sapphire Reserve Annual Fee $550 back

Travel Credit

1. One great benefit of this card is their $300 travel credit. This is one of the main reasons why this card has become so popular. There are a lot of categories that come under this purchase. Below purchases fall under those categories. This should cover most of the people if you travel and use a credit card for those purchases.

Merchants in the travel category include airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages.

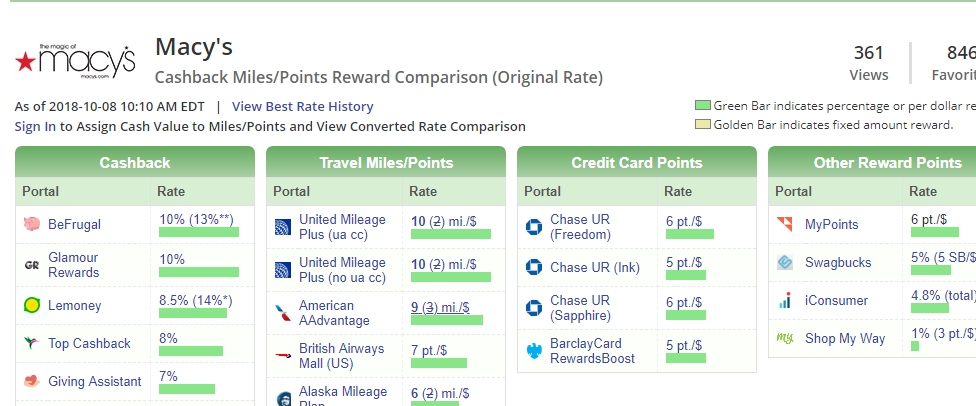

Shop through Chase Cashback

2. If you are shopping online, make use of their shop through Chase benefits. Time to time we have seen an elevated bonus rewards for shop through the Chase Reserve card. Read more at maximizing the Chase UR points post. For calculation perspective, let’s say you earn 5% for $1000 online purchase in a year. This is like $50 worth of UR points. If you join ebates now, you get $10.![]() To know the current rewards points for shopping through Chase, you can track at some monitoring websites like cashback monitor. See an example from Macy’s

To know the current rewards points for shopping through Chase, you can track at some monitoring websites like cashback monitor. See an example from Macy’s

Chase Price Protection Cash Back – No Longer provided by Chase

3. Chase offers a very good price protection. This is something been used frequently and save an average of at least $50 a year by reduction in price. This comes very handy if you are a holiday shopper. There are some automated price protection website where they keep track of it and claim on your behalf. Register at Earny and get the refund claim automatically. I would rate this benefit as at least $50.

https://earny.app.link/

Chase Price protection benefits.

If you purchase an eligible item with your Account in the United States and see a Printed Advertisement at any retail store or Non-auction Internet Advertisement for less within ninety (90) days of the original purchase date, simply file a valid claim and the Benefit Administrator will reimburse you the difference up to five hundred ($500.00) dollars for each item. Price Protection is limited to twenty-five hundred ($2,500.00) dollars a year for each Account.

Get Chase Trifecta to boost their Rewards

4. Chase Freedom, Chase Freedom Unlimited and Chase Sapphire Reserve will make the perfect combination to make the maximum Reserve benefits. If you spend at least $5000 in non-travel or non-dining purchases in a year, you get 1X points with Reserve. I suggest getting Chase Freedom Unlimited earning 1.5% on all purchases, which translates to easy 2.25X when redeemed via Chase Sapphire Reserve. Getting Chase Freedom, which gives 5X on rotating categories (up to $1500 per quarter) would earn 7.5X when redeemed via Chase Sapphire Reserve.

Chase Trifecta Cards

|

after $4000 spend |

after $500 Spend |

after $500 Spend |

See this simple calculation on how much you can earn if you have these three cards in place.

Hope these benefits will help get back the Annual Fee.

Conclusion – Chase Sapphire Reserve Benefits

If you travel enough to maximize the benefits, the Chase Sapphire Reserve is arguably the best premium travel rewards credit card currently available. The 50,000 point sign-up bonus after $4,000 spend in 3 months is the icing on the cake, but the flexible $300 travel credit, Global Entry reimbursement, and complimentary Priority Pass lounge access wipe out the annual fee with ease. It is also a card reward booster for other Chase Ultimate Reward Cards. The Ultimate Reward points go further than other credit card programs and the travel benefits are easier to redeem. Check the Best Chase Ultimate Rewards Guide for Redemption on Travel. The next best premium travel credit card is the Amex Platinum or Citi Prestige, but recent negative changes on Citi Prestige will probably cause them to stick to the Sapphire Reserve.

Alternate to Chase Sapphire Reserve

Chase Sapphire Preferred

Chase Sapphire Preferred is a good option when it comes to travel redemption card. You earn 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards. For example, 50,000 points are worth $625 toward travel. On top of that, you have the same travel partners for redeeming via Airline or Hotel Rewards. Hyatt is one good example where you get good value for your World of Hyatt points. If you want to know how much you can benefit from Chase Travel partners, check the Best Chase Ultimate Rewards Guide for Redemption on Travel.

Amex Platinum

One of the top Executive Premium Card for Consumers. Yes, the annual fee is hefty but given the extra perks that come with this card, there are ample opportunities to offset the annual fee and then you’ll just have a card that opens doors to luxury when you travel.

Relax at the airport in peace and quiet with complimentary access to the Global Lounge Collection worldwide. The collection includes a number of network lounges such as The Centurion® Lounge and Delta SkyClub® lounges as well as the full range of Priority Pass™ Select lounges.

- 60,000 bonus Membership Rewards® points after you make $5,000 in purchases in the first three months.

- 5X points per dollar for flights booked directly with airlines or with American Express Travel and one point per dollar on other purchases.

- $200 in annual Uber savings, Enjoy $15 in Uber credits for U.S. rides each month plus a bonus $20 in December.

- $200 Airline fees credit per the calendar year, can be used to purchase Gift Cards at certain Airlines.

- 24/7 Platinum Club Concierge service to help with travel arrangements and other services.

- A credit of $100 or $85 for your Global Entry or TSA Precheck®, respectively, application fee.

Amex Gold – Recently Launched Card (40,000 points Referral Offer)

The New Amex Gold credit card, let you earn 4% at US restaurants, 4% US supermarkets on up to $25,000 per year and 3X on flights booked directly with airlines or on amextravel.com. This is the best-redesigned product from Amex competing well with competitors.

Though there is an Annual Fee of $250, it easily pays off with $120 DINING CREDIT, $100 AIRLINE FEE CREDIT and left with just $30 in fees. Earn 40,000 Membership Rewards® Points after you spend $2,000 on eligible purchases with your new card within the first 3 months. It’s a no-brainer to not to have this card right now.

The promotional offer using this referral link is good when compared to the direct Amex offer of 35,000.

Capital One Venture Rewards (50,000 Miles Promotion)

If you want to keep your wallet plain and simple, without worrying too much about which card to use at which place or category, Capital One Venture Rewards eliminates that hassle. It earns 2X miles on every purchase, every day. Plus earn 10X miles on thousands of hotels at hotels.com. Capital One Venture Rewards card is now offering 50,000 miles after spending $3,000 in the first 3 months which is worth $500 in travel. It offers $100 application fee credit for Global Entry or TSA Pre-check. Miles can be redeemed for travel at the rate of 100 miles to $1. Capital One recently added below airline partners to transfer miles at the rate of 2 to 1.5 miles.

- Aeromexico Club Premier

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- Alitalia MilleMiglia

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- Etihad Guest

- EVA Infinity MileageLands

- Finnair Plus

- Hainan Fortune Wings Club

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

Below airlines can be transferred at the rate of 2:1.

- Singapore Kris Flyer

- Emirates

This card is definitely worth if you always redeem for travel, Chase and Amex are still by best choice when it comes to Airline or Hotel partners.

50,000 Bonus

50,000 Bonus  $150 or 15,000 Bonus

$150 or 15,000 Bonus  $150 Bonus

$150 Bonus

Earn 60,000 Bonus Points

Earn 60,000 Bonus Points

Leave a Reply