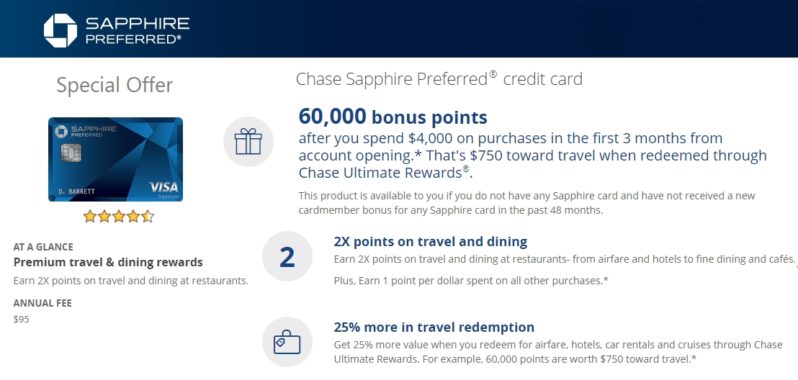

There have been several news articles from the leading publishers about Credit Card Rewards are cut down significantly. This is totally wrong. Chase Ultimate Rewards one of the popular rewards program, doesn’t seem to be going south any time soon. Chase Sapphire Preferred has one of the highest and increased sign-up bonus offer of 60,000 points after $4,000 purchases in the first 3 months. This is the right time to get a new credit card with all the holiday shopping and expense and gain some rewards in your wallet. They even expedite the card with just call away to 888-338-2586 after the approval.

The Chase Sapphire Preferred and Reserve are the top-notch credit card products offered by Chase. Their popularity is driven by their rewards and benefits offered.

Let’s compare, the two most popular Chase Travel Rewards Credit Cards –

Chase Sapphire Preferred and Chase Sapphire Reserve.

| Category/Offers | Chase Sapphire Preferred | Chase Sapphire Reserve |

|---|---|---|

| Bonus Offer | 60,000 Sign-up Bonus | 50,000 Sign-Up Bonus |

| Bonus Offer Worth | $750 | $750 |

| Travel | 2X | 3X |

| Dining | 2X | 3X |

| Annual Fee | $95 | $550 |

| Benefits - Partners | 1:1 to Transfer Travel Partner | 1:1 to Transfer Travel Partner |

| Rewards | 25% more for Travel Redemption | 50% more for Travel Redemption |

| Premium Benefits | None | Priority Pass Benefits |

| TSA/Global Entry Credit | None | Yes, $100 Once every 5 years |

It’s clear from the above comparison, it totally depends on your needs and spends. Let’s also take a look at different variations of benefits comparison and which one makes sense to offset the Annual Fee and the benefits.

Ultimate Rewards Benefit Reserve Vs Preferred

You can earn more rewards when you combine or pool your points with Chase Freedom and Chase Freedom Unlimited. Check out the sample rewards calculation table below.

Check out your potential of how much you can earn using the Chase UR Calculator.

Redeem Points for Flights & Hotel

Chase Sapphire cards offer one of the top rewards redemptions. As you can see in the above table, Sapphire Reserve card points are worth 50% more on travel redemption. Whereas, Sapphire Preferred is 25% in value. But, there is a common benefit between these two, which is transfer to Travel Partners. Both cards let you transfer to below partners and enjoy the same benefit.

Cardmembers can transfer points on a 1:1 ratio (so 1,000 points would equal 1,000 miles) to the following airlines:

- British Airways Executive Club

- Flying Blue AIR FRANCE KLM

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus®

- Virgin Atlantic Flying Club

- Emirates

Check out some best travel redemption that you can make with certain partners.

and to the below Hotel Partners

- World of Hyatt

- IHG® Rewards Club

- Bonvoy by Marriott

Learn some of the best Hotel Redemptions that you can benefit from these partners. The best redemption so far has been with Hyatt, where you can get Hyatt Place or Hyatt House starting from 5000 points and they may actually cost anywhere from $80 to $200 on average.

Trip Cancellation/Trip Interruption Insurance

Cardmember and immediate family members are covered for trip Cancellation provides reimbursement if a covered loss prevents you from traveling on or before the departure date and results in cancellation of the travel arrangements.

Trip Interruption provides reimbursement if a covered loss on the way to the point of departure or after departure causes interruption of your covered trip.

This is covered even when travel is made using points and/or when partial charges are made to Chase Sapphire cards.

Covers up to $10,000 per covered trip and a maximum limit of $20,000 per occurrence and a maximum benefit amount per 12-month period of $40,000

Trip Delay Insurance – If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

Primary Auto Rental Collision Damage Waiver

Both the Chase Sapphire Cards provide primary coverage on car rental collision damage. Once you make the entire purchase using the card and decline the rental company’s collision damage waiver or loss damage waiver, it’s covered.

Things that are covered are

- Physical damage and/or theft of the covered rental vehicle

- Reasonable and customary towing charges related to a covered loss to take the vehicle to the nearest qualified repair facility

- Valid loss-of-use charges incurred by the rental car agency

No Foreign Transaction Fees

This is an excellent benefit, especially if you make an international trip, you can pretty much enjoy putting the dining and travel on this card. There is no foreign transaction fee and still, enjoy category bonus rewards on dining and travel.

Other Benefits but not the Least

Baggage Delays or Lost Luggage – Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days. You or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you’re covered up to $3,000 per passenger.

Travel and Emergency Assistance – Emergency services while away from home, Roadside assistance

Conclusion

It’s clear from the above comparison, if you use the card for Award travel redemption and not worried about premium travel perks, then Chase Sapphire Preferred is a clear winner. If you are a frequent traveler and looking for Travel perks such as Priority Pass and Global Entry/TSA Pre Check credit, then Chase Sapphire Reserve easily pays off your annual fee and better Travel Redemptions rate when redeemed via Chase Portal. If you are a beginner in travel rewards, then you should start with Chase Sapphire Preferred, the main reason is, its so simple to use and not a hefty annual fee. When you decide to enjoy more on the travel perks, you can upgrade to Reserve after 12 months of getting the Preferred.

Earn 60,000 Bonus Points

Earn 60,000 Bonus Points

Leave a Reply