Chase Credit Cardholders are receiving e-mails on some of the important account term changes. The key summary of changes that were recently communicated are:

-

Chase Bank USA, N.A is now referenced as JPMorgan Chase Bank, N.A

-

Change in Minimum Payment

-

New Features – My Chase Loan and My Chase Plan

-

Binding Arbitration

All of these changes except for the change in the Bank’s name are effective from August 10th, 2019. Let’s take a look at what these changes are in detail. How is it going to impact me as cardholder? What do I need to know? The good news is, none of these changes effect the way rewards are earned.

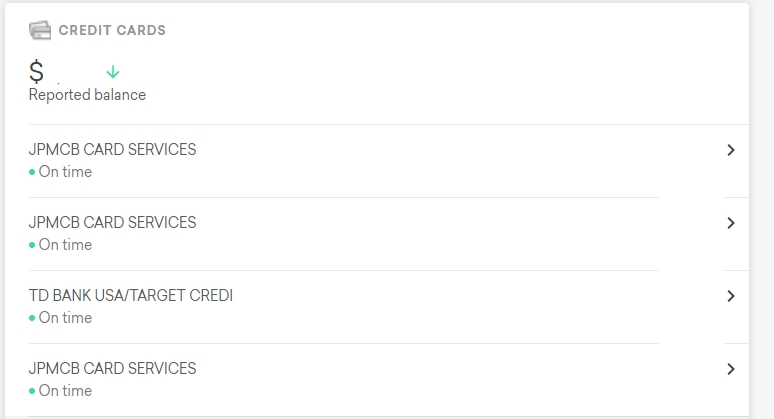

Change in Chase Bank Reference in Agreements and Reporting

All the Bank reference on the agreement, benefits, and guide are now referenced to JPMorgan Chase Bank, N.A., as successor by merger to Chase Bank USA, N.A., on 05/18/2019. The only confusion that this created is, some of the credit reporting agencies started alerting as new account due to change in Bank’s name in the reference. JPMCB is the short name for JPMorgan Chase Bank. There is nothing to panic about it.

According to your TransUnion credit report, someone added you as an authorized user for their JPMCB CARD credit card.

According to your TransUnion credit report, someone added you as an authorized user for their JPMCB CARD credit card.

Credit Karma recently alerted customers that a new account was added to the existing account sent a follow-up e-mail correcting the mistake. There is no cause for concern if you received an alert for new accounts being added under JPMCB Credit Card name.

Minimum Payment Changes

The minimum payment is now being increased to a minimum of $35 if you have a balance above that amount. This does not impact anyone who pays the entire statement balance every month. If you have been paying the minimum amount every month, then you are paying interest charges unless it’s on a promotional 0% APR.

My Chase Loan – New Feature Explained

Chase is launching a new feature called “My Chase Loan”. This is something similar to a Line of Credit. If eligible, you may use the My Chase Loan feature to obtain cash as an electronic deposit into an eligible bank account held by a financial institution located in the United States by accepting a My Chase Loan offer. Each offer will include a My Chase Loan APR and the number of billing periods it will take to pay the My Chase Loan balance in full by making regular payments each monthly billing period.

My Chase Loan transactions are not Cash Advances or Balance Transfers. There could be time to time Financing Offers. When you have a My Chase Loan balance on your account, there is no interest charge on new purchases if you pay your entire Interest Saving Balance by the due date each month.

Since this is a new feature, similar to a balance transfer, you will not earn any rewards on these loans. It is different from the Balance Transfer or Cash Advance and I hope there won’t be any fee to avail this feature.

My Chase Plan – New Feature Explained

This is another feature something similar to a feature offered in the past as Split or Finish it under Blueprint. If eligible, you may use the My Chase Plan feature on recent eligible purchase transactions. From the available offers, you may select how many billing periods it will take to pay the My Chase Plan balance in full by making regular payments each monthly billing period. For each billing period during which there is a balance in the My Chase Plan, you will be charged the My Chase Plan Fee, rather than interest under the Purchase APR.

This is similar to the Amex Plan It. Plan It lets you split up large purchases into monthly payments for a fixed monthly fee and no interest charges.

When you have a My Chase Plan balance on your account, there won’t be any interest charge on new purchases if you pay your entire Interest Saving Balance by the due date each month.

These two new features are not enticing if you are paying your balances in full every month. It might be beneficial for someone with a limited budget and have a huge spend to pay off over a few months.

Arbitration Binding

This arbitration agreement will surrender the right to go to court when you have any dispute with Chase. You have to go to a third party “arbiter.” Arbitration is conducted by private organizations that specialize in alternative dispute resolution and is conducted before a neutral arbitrator instead of a judge or jury. Arbitration procedures are generally simpler and more informal than court procedures.

There is a big Reddit discussion about it.

Most of the financial products include an arbitration clause. Lawsuits are generally expensive for both consumers as well as Financial bodies. When Financial companies make a loss on the lawsuits, some of that financial burden would be passed on to consumers.

One recent example, Visa and Mastercard settled on a $6.2 billion amount on a long-running lawsuit brought by merchants over fees on credit card transactions.

The consumer bureau studied American Arbitration Association data for 2010-2012 in cases involving credit cards; checking account/debit cards; payday loans; prepaid cards; private student loans; and auto loans. In all, consumers filed an average of 411 cases each year. The average debt amount under dispute was nearly $16,000, and the median was roughly $11,000, the report found.

Again citing the federal watchdog’s study data, the three financial service providers said average consumer relief in arbitration proceedings was $5,389, compared with a $32.35 average in class-action case settlements.

However, you have the right to reject this agreement to arbitrate if you notify Chase no later than 8/9/2019. You must do so in writing by stating that you reject this agreement to arbitrate and include your name, account number, address and personal signature. Your notice must be mailed to us at P.O. Box 15298, Wilmington, DE 19850-5298.

Can prepare a written mail as below. please note, will have to include all the cards that you own as a Primary Cardholder.

“I would like to Opt-out of the Arbitration Agreement with JPMorgan Chase Bank, N.A. and Chase Bank USA, N.A., all of their parents, subsidiaries, affiliates, successors, predecessors, employees, and related persons or entities and all third parties who are regarded as agents or representatives of us in connection with the below account”

Name :

CC Number:

Address:

Regards,

(Signature)

(Full Name)

Earn 60,000 Bonus Points

Earn 60,000 Bonus Points

Leave a Reply